This article was co-authored by TFX Industry Advisory Board members Chris Bollinger, Kyle Teamey and William Treseder.

The relationship between the technology industry and foreign affairs, in particular the defense sector, is increasingly intertwined. Technological advantage in consumer and enterprise products will directly feed into the race for competitive advantage in air, land, sea, space, and cyber power among nation states. The increasing threat of technological disruption will define 21st-century warfare, concentrating on emerging technologies such as AI and quantum computing. If harnessed strategically, advancements in commercial software can be strategically used to advance Department of Defense (DoD) missions.

Our nation’s competitors possess technology capabilities that can effectively mobilize their society to quickly deploy new capabilities. It is crucial that U.S. defense and related communities leverage the immense creativity of America’s private sector to keep pace. Our men and women in uniform deserve access to cutting-edge innovation. Allocating adequate resources in the defense budget for defense tech and innovation programs must be prioritized. We have seen promising signs on the horizon, including the newly unveiled defense budget that will increase spending by nearly 10% in areas such as microelectronics, 5G networking and biotechnology, and a growing comfort in the use of cloud-backed services. Even when backing out inflation much more is needed.

Over the last decade, Silicon Valley has heavily invested into these sectors, while allowing startups that aggressively pursue business with the Department of Defense that will lead to lasting partnerships. We are seeing alumni from the first wave of defense startups, such as Palantir, Anduril and Shield AI, form the next generation of defense startups. However, significant work remains to ensure those with responsibilities for the nation’s defense and national security posture can access the latest defense tech innovations from the commercial sector. Follow along in this article for our insight on how we see innovative startups fitting in, where progress has been made, and what challenges still lie ahead.

Over the last decade, Silicon Valley has heavily invested into these sectors, while allowing startups that aggressively pursue business with the Department of Defense that will lead to lasting partnerships. We are seeing alumni from the first wave of defense startups, such as Palantir, Anduril and Shield AI, form the next generation of defense startups. However, significant work remains to ensure those with responsibilities for the nation’s defense and national security posture can access the latest defense tech innovations from the commercial sector. Follow along in this article for our insight on how we see innovative startups fitting in, where progress has been made, and what challenges still lie ahead.

Progress is Being Made Inside the Pentagon

Bill LaPlate, the nominee to be the Pentagon’s next acquisitions chief, stressed in his nomination hearing last month that the Pentagon’s acquisition system needs to focus on delivering new capabilities to meet the quickly evolving threat from China and other leading adversaries. He also noted the Pentagon must lower the barriers keeping small, non-traditional or startup companies from doing business in the defense technology and industrial base.

Consolidation in the defense industry has no doubt hurt the Defense Department by reducing the competition that drives innovation and speed. Increasing opportunities for startups to compete for defense contracts could provide an incentive to make sure traditional defense contractors don’t become stagnant. However, many in the tech and defense communities believe that the Pentagon needs to reduce its traditional reliance on established defense contractors. Why? They believe that when it comes to innovation and competitive advantage, traditional contractors may lack the talent and agility to conceive and develop high-tech defenses against the quickly evolving global threats.

Well-funded startups have the ability to develop and deliver innovation at faster speeds but can become stymied by the Pentagon’s rigid and slower procurement systems. While the capabilities are present, they must navigate complex procurement processes that are more easily won by legacy contractors.

However, there are signs that tech companies are being given more representation in the traditionally rigid system. Just last month Mike Bloomberg was named chair of the Defense Innovation Board, the prestigious Pentagon oversight committee that makes technology recommendations to the Department of Defense Secretary and other top officials.

What’s Next for Dual-Use Technology

Over the coming decade, dual-use technology will grow, and venture capital money will continue to chase it so long as DoD continues its march towards increased collaboration with technology startups and their venture capital backers. Developing dual-use technology allows companies to minimize financial risk by maintaining a commercial sales cycle that can help weather the often long, and difficult government procurement pathways. These partnerships are also expanding into relationships between defense startups and “Big Tech” companies, where defense startups are extracting proven capabilities from the most successful technology companies to drive innovation forward.

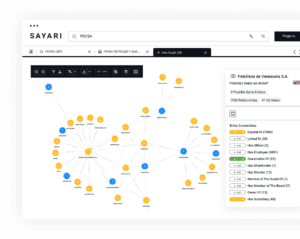

One such example is Sayari, a TFX portfolio company. Delivering corporate data and financial intelligence, Sayari allows its users to transact and trade with confidence in a complex, globalized economy. Sayari’s platform is the world’s largest database of companies, including their key people, and their most important relationships, and is a global leader in software powering the fight against financial crime and increasing corporate transparency in high risk places.

One such example is Sayari, a TFX portfolio company. Delivering corporate data and financial intelligence, Sayari allows its users to transact and trade with confidence in a complex, globalized economy. Sayari’s platform is the world’s largest database of companies, including their key people, and their most important relationships, and is a global leader in software powering the fight against financial crime and increasing corporate transparency in high risk places.

Its platform, which includes Sayari Graph, harnesses the proliferation of digitized commercial registries and government regulatory disclosures to produce the most accurate model of commercial and financial relationships. Its proprietary pipelines collect, extract, enrich, match, and analyze high value information from over 150 countries, enabling enterprises to have a complete picture of over 400 million companies’ customers, counterparties, and competitors. Sayari’s customers include not only some of the world’s largest companies and financial institutions but also numerous government agencies, to include the U.S. Departments of Homeland Security, Justice, State, Treasury and Defense.

Potential within Existing Innovation-Focused DoD Programs

While challenges remain, over the last decade the Department of Defense has invested in developing programs to encourage collaboration with the private sector. These efforts have been fruitful, albeit with some stumbles. Continuing to leverage – and improve – these programs will be critical and will simultaneously encourage the commercialization of dual-use defense technologies and partnerships.

One such example is the Small Business Innovative Research (SBIR) funding programs, run by the Department of Defense and ten other government agencies. SBIRs provide $50,000 to upwards of multiple $10 million in non-dilutive, research-focused awards that can often be overlooked by investors and Founders. Despite limited awareness, the U.S. Air Force SBIR, AFWERX, has been an active program, and in 2020, they distributed over $500 million in non-dilutive grants to over 1,000 startups.

As of late, more effort has also been focused on talent within the SBIRs. The newly announced JADC2 is at the center of the Pentagon’s tech-centric campaign to overhaul military communications and better handle streams of data. While defense technology is the focus, this SBIR also recognizes the urgency of cultivating talent, and strengthening of policies and processes for implementation.

In addition to establishing SBIR funding programs, the Pentagon has actively invested in relationship building with the private sector. In 2015, the Defense Innovation Unit (DIUx) Experimental was founded to help the U.S. military make faster use of emerging commercial technologies. After an initial “experiment” period, the “x” was dropped, and the mission made permanent with vast improvements along the way. One such improvement included DIU’s expansion beyond Silicon Valley with regional growth in Boston, Washington, DC, Austin, and most recently Chicago. This regional strategy recognizes that some of the newest and most innovative tech start-ups are building across the country. However, its mission has narrowed along the way demonstrating that innovators that stay savvy on contracting priorities are more likely to prosper in this ecosystem. Other notable efforts have included the creation of the Army Futures Command (AFC) in Austin in 2018 designed to run modernization projects for the Army through public-private partnerships, and the Defense Digital Service (DDS) which was formed in 2014 by government and technology leaders, including former Google CEO Eric Schmidt, to tackle the most challenging technology problems that threaten national security.

In addition to establishing SBIR funding programs, the Pentagon has actively invested in relationship building with the private sector. In 2015, the Defense Innovation Unit (DIUx) Experimental was founded to help the U.S. military make faster use of emerging commercial technologies. After an initial “experiment” period, the “x” was dropped, and the mission made permanent with vast improvements along the way. One such improvement included DIU’s expansion beyond Silicon Valley with regional growth in Boston, Washington, DC, Austin, and most recently Chicago. This regional strategy recognizes that some of the newest and most innovative tech start-ups are building across the country. However, its mission has narrowed along the way demonstrating that innovators that stay savvy on contracting priorities are more likely to prosper in this ecosystem. Other notable efforts have included the creation of the Army Futures Command (AFC) in Austin in 2018 designed to run modernization projects for the Army through public-private partnerships, and the Defense Digital Service (DDS) which was formed in 2014 by government and technology leaders, including former Google CEO Eric Schmidt, to tackle the most challenging technology problems that threaten national security.

Opportunities Abound with Private Sector-Fueled Investments

Over the last several years, we have also witnessed growing energy through private sector firms to catalyze investments into defense tech. Historically, venture-backed startups have not aggressively pursued military and defense as their core customer, nor have firms focused on investment opportunities here. This shift is a response to the opportunity at hand to compete for major contracts addressing critical national security threats. A recent Deltek report predicted that the DoD contractor IT market would grow at a compound annual rate of 1 percent, to reach $55.7 billion by 2025, with advancements in adoption of 5G, cloud, AI, IoT, and other modern commercial platforms.

Notable examples here include the newly created defense tech venture capital firm Shield Capital, focused on the acceleration of frontier technology solutions in the defense sector. Raj Shah, former director of DIU, serves as a managing partner. Other investment firms, including Lux Capital, Founders Fund, LavRock Ventures, New North Ventures and Ridgeline Partners, continue to grow their defense tech investments.

This growth builds on the foundation built by In-Q-Tel and DARPA, the original vanguards for partnering with emerging tech startups and importing their capabilities into national security arenas. In addition, the Defense Investors Network (DIN) and Silicon Valley Defense Group continue to strengthen investment networks aimed at defense tech advancements.

As these networks organically grow, and private sector investment chases opportunities, we should expect to see more defense tech companies, such as Andurl, Shield AI, Rebellion Defense, and Second Front Systems, scale and successfully compete within DoD procurement opportunities.

What’s Ahead

What’s Ahead

TFX believes that startups working with government agencies and focusing on them as a customer will happen more organically. However, it will require software startups, and other defense tech commercial providers, to be open to putting the work in to develop the DoD and national security agencies as customers, and embracing pathways available for advancement.

A business relationship with the Pentagon is different from a relationship with commercial clients – and even other non-defense government agencies and departments. Recognizing the security-measures and rigid nature of contracting, startups should not miss opportunities to participate in programs like SBIR, collaborate with DIU and monitor recommendations made by the Defense Innovation Board. These new gateways provide a tremendous opportunity for start-ups to ease some of the traditional hurdles presented for government contracting.

As investors and champions for high-performing, former military and national security leaders, we know that competing asymmetrically is exactly what our founders do best. Their ambitious nature and acclimation to scarce resources mean they repeatedly do more with less. They are used to constant competition; they share an innate desire to innovate; and they regularly identify their own weaknesses to relentlessly exploit them to create competitive advantage. They also have experience with national security mission priorities and gaps as well as familiarity with navigating DoD.

While the hurdles associated with Defense contracts are often discussed, we also recognize the benefits of pursuing these contracts for venture-backed start-ups. For starters, the contract award amounts are larger, more enduring, and can help any venture-backed start-up build product and revenue growth maturity versus focusing solely on a B2B SaaS sales model and Go to Market strategy. Additionally, a start-up that proves its viability of deployment within the Defense Department, only strengthens its value in front of future investors and commercial sales opportunities.

At TFX, we know U.S. startups have the technology and capabilities to bolster defense and strengthen national security – and have the opportunity to succeed amidst the rapid innovation taking place within the Department of Defense. Streamlining standards for next-generation technologies, particularly in software, will be paramount to help alleviate hurdles for entry while maintaining rigid security protocols. As defense and military leaders consider American challenges from abroad, defense tech will be among the next big sectors primed for investments as long as there remains a willingness to flexibly evolve and remove barriers to entry for startups ready to serve.